In a profound and unsettling conversation on “The Journey Man,” Raoul Pal sits down with Emad Mostaque, co-founder of Stability AI, to discuss the imminent ‘Economic Singularity.’ Their core thesis: super-intelligent, rapidly cheapening AI is poised to make all human cognitive and physical labor economically obsolete within the next 1-3 years. This shift will fundamentally break and reshape our current economic models, society, and the very concept of value.

This isn’t a far-off science fiction scenario; they argue it’s an economic reality set to unfold within the next 1,000 days. We’ve captured the full summary, key takeaways, and detailed breakdown of their entire discussion below.

🚀 Too Long; Didn’t Watch (TL;DW)

The video is a discussion about how super-intelligent, rapidly cheapening AI is poised to make all human cognitive and physical labor economically obsolete within the next 1-3 years, leading to an “economic singularity” that will fundamentally break and reshape our current economic models, society, and the very concept of value.

Executive Summary: The Coming Singularity

Emad Mostaque argues we are at an “intelligence inversion” point, where AI intelligence is becoming uncapped and incredibly cheap, while human intelligence is fixed. The cost of AI-driven cognitive work is plummeting so fast that a full-time AI “worker” will cost less than a dollar a day within the next year.

This collapse in the price of labor—both cognitive and, soon after, physical (via humanoid robots)—will trigger an “economic singularity” within the next 1,000 days. This event will render traditional economic models, like the Fed’s control over inflation and unemployment, completely non-functional. With the value of labor going to zero, the tax base evaporates and the entire system breaks. The only advice: start using these AI tools daily (what Mostaque calls “vibe coding”) to adapt your thinking and stay on the cutting edge.

Key Takeaways from the Discussion

- New Economic Model (MIND): Mostaque introduces a new economic theory for the AI age, moving beyond old scarcity-based models. It identifies four key capitals: Material, Intelligence, Network, and Diversity.

- The Intelligence Inversion: We are at a point where AI intelligence is becoming uncapped and incredibly cheap, while human intelligence is fixed. AI doesn’t need to sleep or eat, and its cost is collapsing.

- The End of Cognitive Work: The cost of AI-driven cognitive work is plummeting. What cost $600 per million tokens will soon cost pennies, making the cost of a full-time cognitive AI worker less than a dollar a day within the next year.

- The “Economic Singularity” is Imminent: This price collapse will lead to an “economic singularity,” where current economic models no longer function. They predict this societal-level disruption will happen within the next 1,000 days, or 1-3 years.

- AI Will Saturate All Benchmarks: AI is already winning Olympiads in physics, math, and coding. It’s predicted that AI will meet or exceed top-human performance on every cognitive benchmark by 2027.

- Physical Labor is Next: This isn’t limited to cognitive work. Humanoid robots, like Tesla’s Optimus, will also drive the cost of physical labor to near-zero, replacing everyone from truck drivers to factory workers.

- The New Value of Humans: In a world where AI performs all labor, human value will shift to things like network connections, community, and unique human experiences.

- Action Plan – “Vibe Coding”: The single most important thing individuals can do is to start using these AI tools daily. Mostaque calls this “vibe coding”—using AI agents and models to build things, ask questions, and change the way you think to stay on the cutting edge.

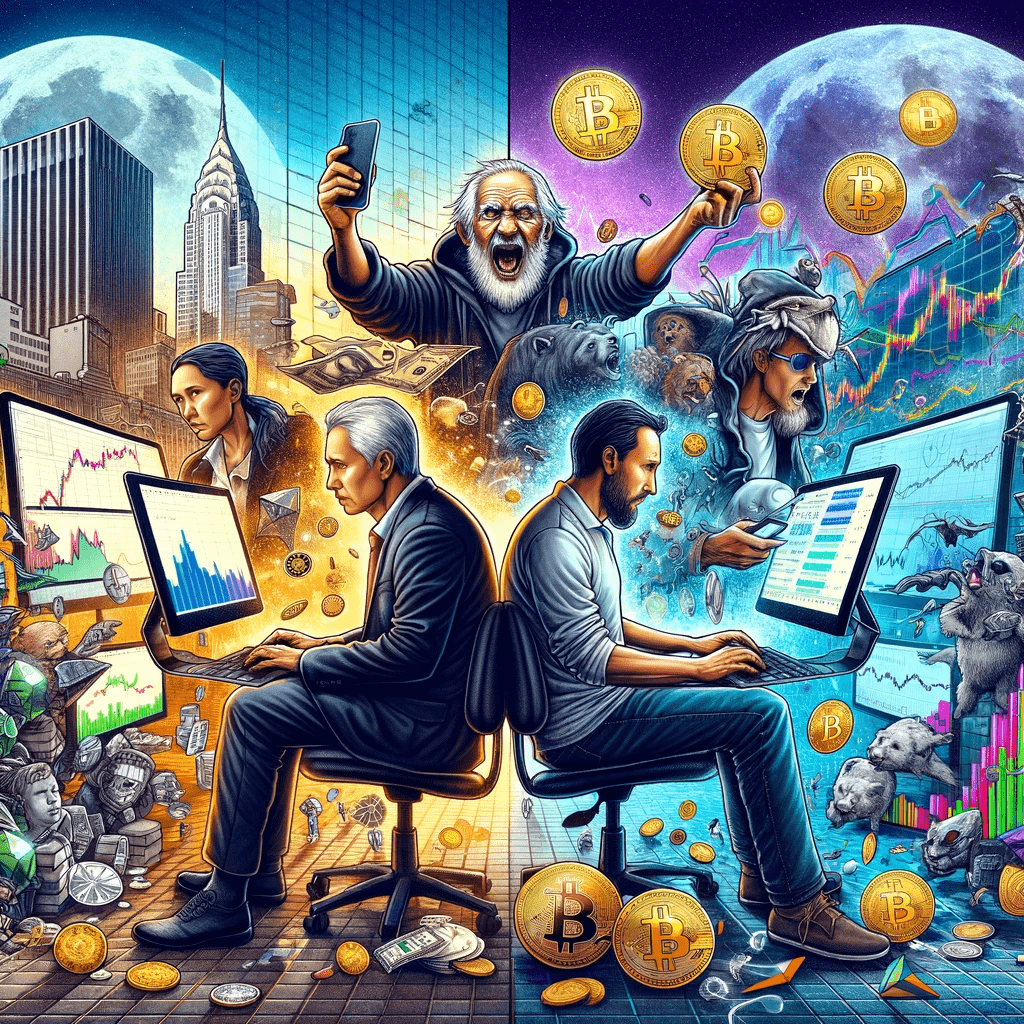

- The “Life Raft”: Both speakers agree the future is unpredictable. This uncertainty leads them to conclude that digital assets (crypto) may become a primary store of value as people flee a traditional system that is fundamentally breaking.

Watch the full, mind-bending conversation here to get the complete context from Raoul Pal and Emad Mostaque.

Detailed Summary: The End of Scarcity Economics

The conversation begins with Raoul Pal introducing his guest, Emad Mostaque, who has developed a new economic theory for the “exponential age.” Emad explains that traditional economics, built on scarcity, is obsolete. His new model is based on generative AI and redefines capital into four types: Material, Intelligence, Network, and Diversity (MIND).

The Intelligence Inversion and Collapse of Labor

The core of the discussion is the concept of an “intelligence inversion.” AI models are not only matching but rapidly exceeding human intelligence across all fields, including math, physics, and medicine. More importantly, the cost of this intelligence is collapsing. Emad calculates that the cost for an AI to perform a full day’s worth of human cognitive work will soon be pennies. This development, he argues, will make almost all human cognitive labor (work done at a computer) economically worthless within the next 1-3 years.

The Economic Singularity

This leads to what Pal calls the “economic singularity.” When the value of labor goes to zero, the entire economic system breaks. The Federal Reserve’s tools become useless, companies will stop hiring graduates and then fire existing workers, and the tax base (which in the US is mostly income tax) will evaporate.

The speakers stress that this isn’t a distant future; AI is predicted to “saturate” or beat all human benchmarks by 2027. This revolution extends to physical labor as well. The rise of humanoid robots means all manual labor will also go to zero in value, with robots costing perhaps a dollar an hour.

Rethinking Value and The Path Forward

With all labor (cognitive and physical) becoming worthless, the nature of value itself changes. They posit that the only scarce things left will be human attention, human-to-human network connections, and provably scarce digital assets. They see the coming boom in digital assets as a direct consequence of this singularity, as people panic and seek a “life raft” out of the old, collapsing system.

They conclude by discussing what an individual can do. Emad’s primary advice is to engage with the technology immediately. He encourages “vibe coding,” which means using AI tools and agents daily to build, create, and learn. This, he says, is the only way to adapt your thinking and stay relevant in the transition. They both agree the future is completely unknown, but that embracing the technology is the only path forward.