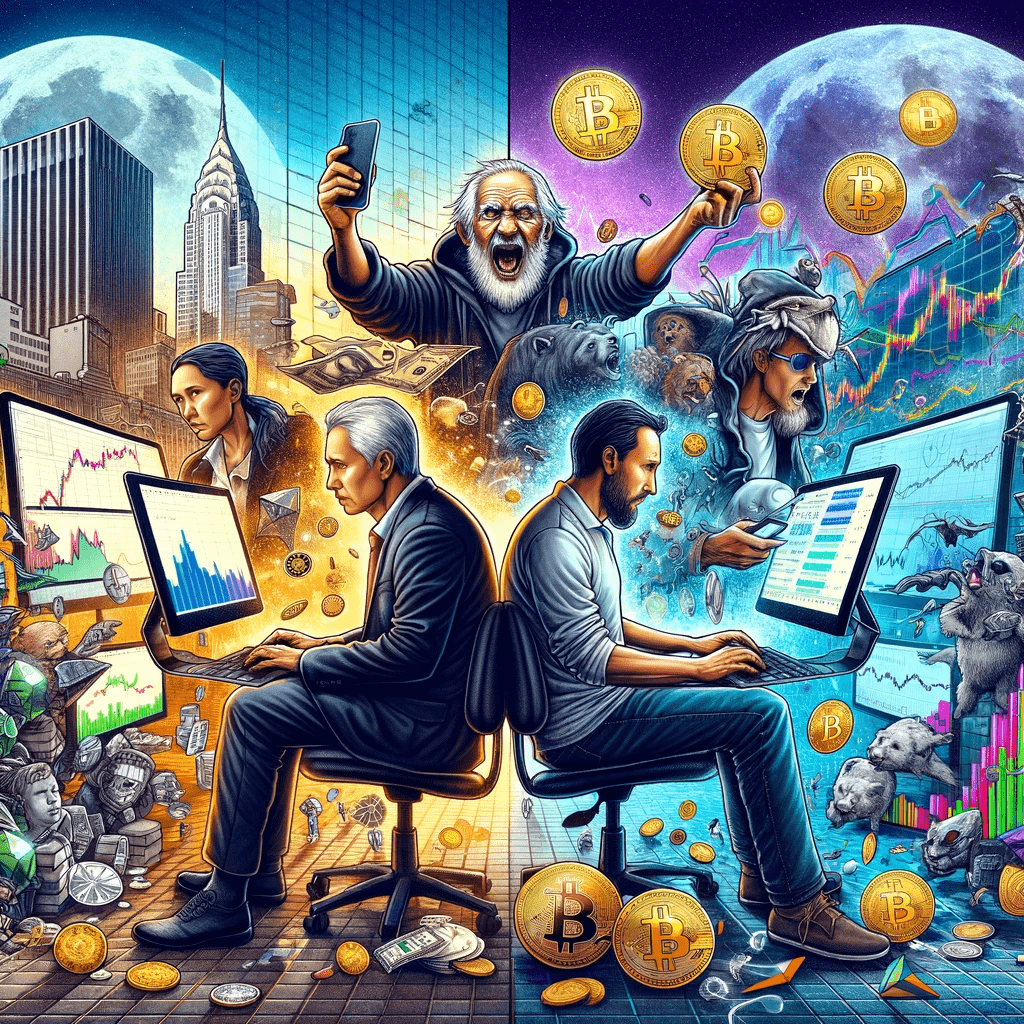

In the ever-evolving world of cryptocurrency, jargon and slang play a significant role in defining one’s understanding and status within the community. One term that has gained traction is “normie,” often used by seasoned crypto enthusiasts to describe newcomers or those less familiar with the intricate workings of the crypto world. This article delves into the characteristics of a “normie” versus a crypto OG (Original Gangster) and provides insights on how to determine if you fall into the former category.

Understanding the Crypto ‘Normie’

A “normie” in crypto terms typically refers to someone new to the cryptocurrency space or someone who has a surface-level understanding of digital currencies and blockchain technology. This individual might have joined the crypto bandwagon influenced by mainstream media hype or peer pressure without a deep comprehension of the underlying principles of decentralized finance (DeFi).

Behaviors of Normies vs. Crypto OGs

Investment Approach: Normies are often characterized by their cautious or conventional investment approach. They might stick to well-known cryptocurrencies like Bitcoin and Ethereum, hesitant to explore lesser-known altcoins. Conversely, crypto OGs, who have been in the space since its nascent stages, are more adventurous, diversifying their portfolios with various digital assets, including DeFi tokens and NFTs (Non-Fungible Tokens).

Market Reaction: The cryptocurrency market is known for its volatility. Normies might react hastily to market fluctuations, often swayed by the FOMO (Fear of Missing Out) or FUD (Fear, Uncertainty, and Doubt) generated by the media. In contrast, crypto OGs usually exhibit a more measured response, relying on their experience and understanding of market cycles.

Community Engagement: Normies may not be as active in crypto forums or social media discussions. They often rely on mainstream news for information, unlike crypto OGs who are deeply ingrained in the community, engaging in discussions on platforms like Reddit, Twitter, or specialized crypto forums.

How to Tell if You Are a Normie

- Your Knowledge Base: If your understanding of crypto is limited to its price movements and you find blockchain technology concepts baffling, you might be a normie.

- Source of Information: Relying solely on mainstream media for crypto news is another hallmark of a normie. Crypto OGs often turn to niche blogs, whitepapers, and community discussions for their information.

- Investment Behavior: If your investment strategy lacks diversification and is driven by hype rather than research, this is a normie trait.

Embracing the Learning Curve

Being a normie isn’t a permanent label. The crypto world is welcoming and educational resources are abundant. Whether you’re a normie or aspiring to be a crypto OG, the key lies in continuous learning and staying updated with the dynamic landscape of cryptocurrency. Remember, every expert was once a beginner, and the journey from a normie to a seasoned crypto enthusiast is an enriching experience filled with learning opportunities.