In a world where artificial intelligence is advancing at breakneck speed, Alibaba Cloud has just thrown its hat into the ring with a new contender: QwQ-32B. This compact reasoning model is making waves for its impressive performance, rivaling much larger AI systems while being more efficient. But what exactly is QwQ-32B, and why is it causing such a stir in the tech community?

What is QwQ-32B?

QwQ-32B is a reasoning model developed by Alibaba Cloud, designed to tackle complex problems that require logical thinking and step-by-step analysis. With 32 billion parameters, it’s considered compact compared to some behemoth models out there, yet it punches above its weight in terms of performance. Reasoning models like QwQ-32B are specialized AI systems that can think through problems methodically, much like a human would, making them particularly adept at tasks such as solving mathematical equations or writing code.

Built on the foundation of Qwen2.5-32B, Alibaba Cloud’s latest large language model, QwQ-32B leverages the power of Reinforcement Learning (RL). RL is a technique where the model learns by trying different approaches and receiving rewards for correct solutions, similar to how a child learns through play and feedback. This method, when applied to a robust foundation model pre-trained on extensive world knowledge, has proven to be highly effective. In fact, the exceptional performance of QwQ-32B highlights the potential of RL in enhancing AI capabilities.

Stellar Performance Across Benchmarks

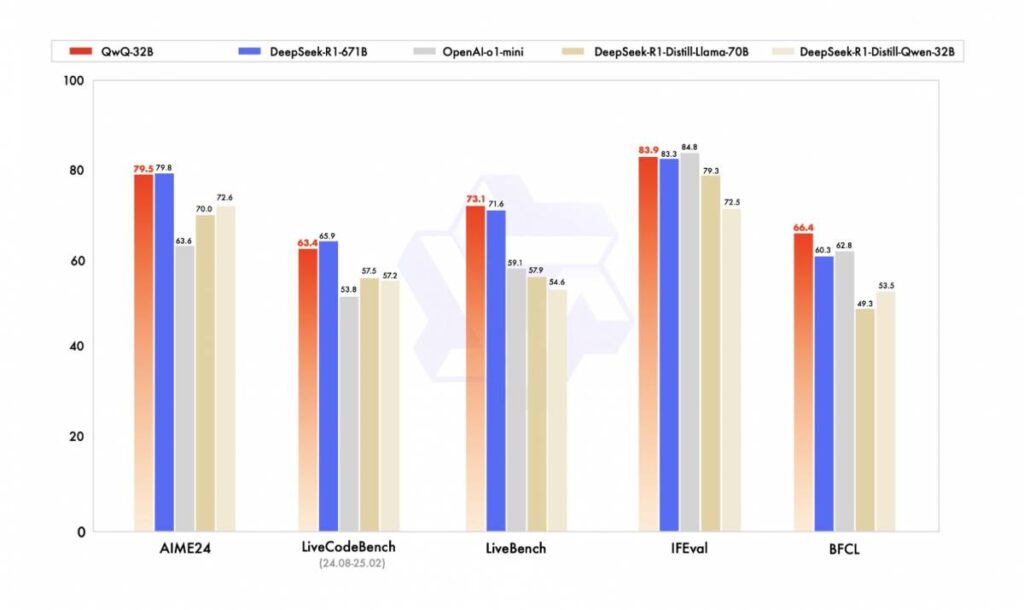

To test its mettle, QwQ-32B was put through a series of rigorous benchmarks. Here’s how it performed:

- AIME 24: Excelled in mathematical reasoning, showcasing its ability to solve challenging math problems.

- Live CodeBench: Demonstrated top-tier coding proficiency, proving its value for developers.

- LiveBench: Performed admirably in general evaluation tasks, indicating broad competence.

- IFEval: Showed strong instruction-following skills, ensuring it can execute tasks as directed.

- BFCL: Highlighted its capabilities in tool and function-calling, a key feature for practical applications.

When stacked against other leading models, such as DeepSeek-R1-Distilled-Qwen-32B and o1-mini, QwQ-32B holds its own, often matching or even surpassing their capabilities despite its smaller size. This is a testament to the effectiveness of the RL techniques employed in its training. Additionally, the model was trained using rewards from a general reward model and rule-based verifiers, which further enhanced its general capabilities. This includes better instruction-following, alignment with human preferences, and improved agent performance.

Agent Capabilities: A Step Beyond Reasoning

What sets QwQ-32B apart is its integration of agent-related capabilities. This means the model can not only think through problems but also interact with its environment, use tools, and adjust its reasoning based on feedback. It’s like giving the AI a toolbox and teaching it how to use each tool effectively. The research team at Alibaba Cloud is even exploring further integration of agents with RL to enable long-horizon reasoning, where the model can plan and execute complex tasks over extended periods. This could be a significant step towards more advanced artificial intelligence.

Open-Source and Accessible to All

Perhaps one of the most exciting aspects of QwQ-32B is that it’s open-source. Available on platforms like Hugging Face and Model Scope under the Apache 2.0 license, it can be freely downloaded and used by anyone. This democratizes access to cutting-edge AI technology, allowing developers, researchers, and enthusiasts to experiment with and build upon this powerful model. The open-source nature of QwQ-32B is a boon for the AI community, fostering innovation and collaboration.

The buzz around QwQ-32B is palpable, with posts on X (formerly Twitter) reflecting public interest and excitement about its capabilities and potential applications. This indicates that the model is not just a technical achievement but also something that captures the imagination of the broader tech community.

A Bright Future for AI

In a field where bigger often seems better, QwQ-32B proves that efficiency and smart design can rival sheer size. As AI continues to evolve, models like QwQ-32B are paving the way for more accessible and powerful tools that can benefit society as a whole. With Alibaba Cloud’s commitment to pushing the boundaries of what’s possible, the future of AI looks brighter than ever.