Overview

Figure has unveiled Figure 03, its third-generation humanoid robot designed for Helix, the home, and mass production at scale. This release marks a major step toward truly general-purpose robots that can perform human-like tasks, learn directly from people, and operate safely in both domestic and commercial environments.

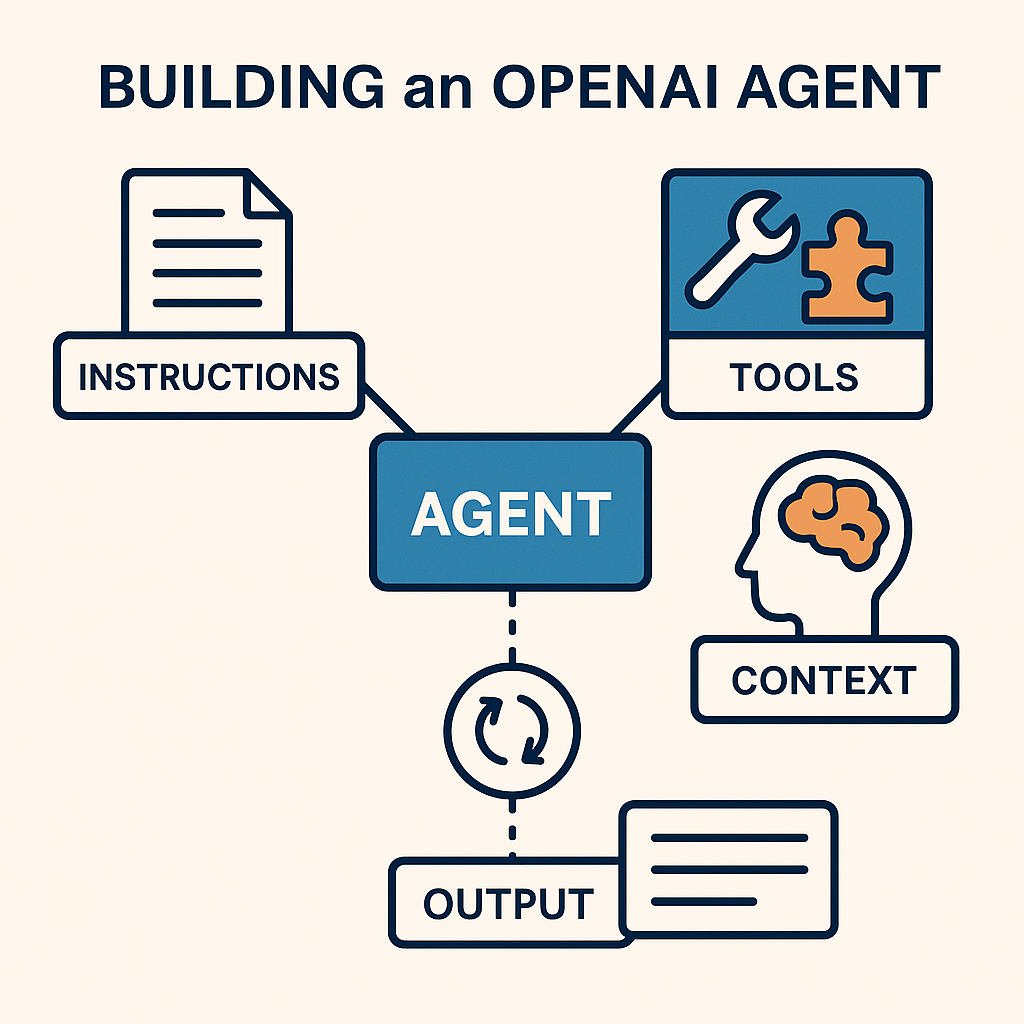

Designed for Helix

At the heart of Figure 03 is Helix, Figure’s proprietary vision-language-action AI. The robot features a completely redesigned sensory suite and hand system built to enable real-world reasoning, dexterity, and adaptability.

Advanced Vision System

The new camera architecture delivers twice the frame rate, 25% of the previous latency, and a 60% wider field of view, all within a smaller form factor. Combined with a deeper depth of field, Helix receives richer and more stable visual input — essential for navigation and manipulation in complex environments.

Smarter, More Tactile Hands

Each hand includes a palm camera and soft, compliant fingertips. These sensors detect forces as small as three grams, allowing Figure 03 to recognize grip pressure and prevent slips in real time. This tactile precision brings human-level control to delicate or irregular objects.

Continuous Learning at Scale

With 10 Gbps mmWave data offload, the Figure 03 fleet can upload terabytes of sensor data for Helix to analyze, enabling continuous fleet-wide learning and improvement.

Designed for the Home

To work safely around people, Figure 03 introduces soft textiles, multi-density foam, and a lighter frame — 9% less mass and less volume than Figure 02. It’s built for both safety and usability in daily life.

Battery and Safety Improvements

The new battery system includes multi-layer protection and has achieved UN38.3 certification. Every safeguard — from the cell to the pack level — was engineered for reliability and longevity.

Wireless, Voice-Enabled, and Easy to Live With

Figure 03 supports wireless inductive charging at 2 kW, so it can automatically dock to recharge. Its upgraded audio system doubles the speaker size, improves microphone clarity, and enables natural speech interaction.

Designed for Mass Manufacturing

Unlike previous prototypes, Figure 03 was designed from day one for large-scale production. The company simplified components, introduced tooled processes like die-casting and injection molding, and established an entirely new supply chain to support thousands of units per year.

- Reduced part count and faster assembly

- Transition from CNC machining to high-volume tooling

- Creation of BotQ, a new dedicated manufacturing facility

BotQ’s first line can produce 12,000 units annually, scaling toward 100,000 within four years. Each unit is tracked end-to-end with Figure’s own Manufacturing Execution System for precision and quality.

Designed for the World at Scale

By solving for safety and variability in the home, Figure 03 becomes a platform for commercial use as well. Its actuators deliver twice the speed and improved torque density, while enhanced perception and tactile feedback enable industrial-level handling and automation.

Wireless charging and data transfer make near-continuous operation possible, and companies can customize uniforms, materials, and digital side screens for branding or safety identification.

Wrap Up

Figure 03 represents a breakthrough in humanoid robotics — combining advanced AI, safe design, and scalable manufacturing. Built for Helix, the home, and the world at scale, it’s a step toward a future where robots can learn, adapt, and work alongside people everywhere.