Creating a budget can be an effective tool for managing your finances and reaching your financial goals. But many people struggle to stick to their budget, and it can be difficult to know where to start. In this article, we’ll discuss some tips and tricks for creating a budget that actually works.

- Be realistic: One of the most important things to keep in mind when creating a budget is to be realistic. Don’t set unrealistic goals or cut back on spending too drastically. Instead, start by making small changes and gradually increase your savings over time.

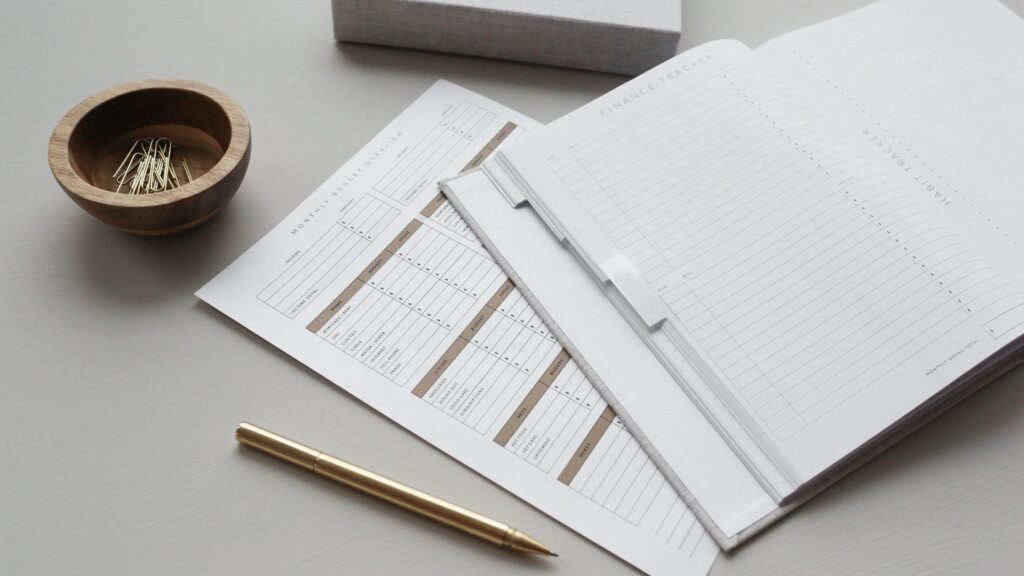

- Track your expenses: To create an effective budget, you need to know where your money is going. Start by tracking your expenses for one month and categorize them into different areas such as housing, transportation, food, and entertainment.

- Prioritize your expenses: Once you know where your money is going, you can prioritize your expenses. Focus on your essential expenses such as housing, food, and transportation. Then, allocate any extra money towards your savings and debt repayment.

- Look for ways to save money: To stick to your budget, you need to find ways to save money. This can include cutting back on unnecessary expenses, shopping around for the best deals, and finding ways to reduce your bills.

- Be flexible: Life is unpredictable, and unexpected expenses can pop up at any time. Be prepared for this by having a small emergency fund and being flexible with your budget.

- Make it a habit: To make your budget effective, you need to make it a habit. Review your budget regularly and make adjustments as needed. This can help you stay on track and achieve your financial goals.

- Use technology: There are many budgeting apps and tools that can help you track your spending, create a budget, and stay on track. These apps can be a great way to make budgeting easier and more convenient.

Creating a budget that works takes time, effort, and commitment. By being realistic, tracking your expenses, prioritizing your expenses, looking for ways to save money, being flexible, making it a habit, and using technology you can create an effective budget that can help you reach your financial goals.